2025 401k Contribution Limit Catch Up Over 50

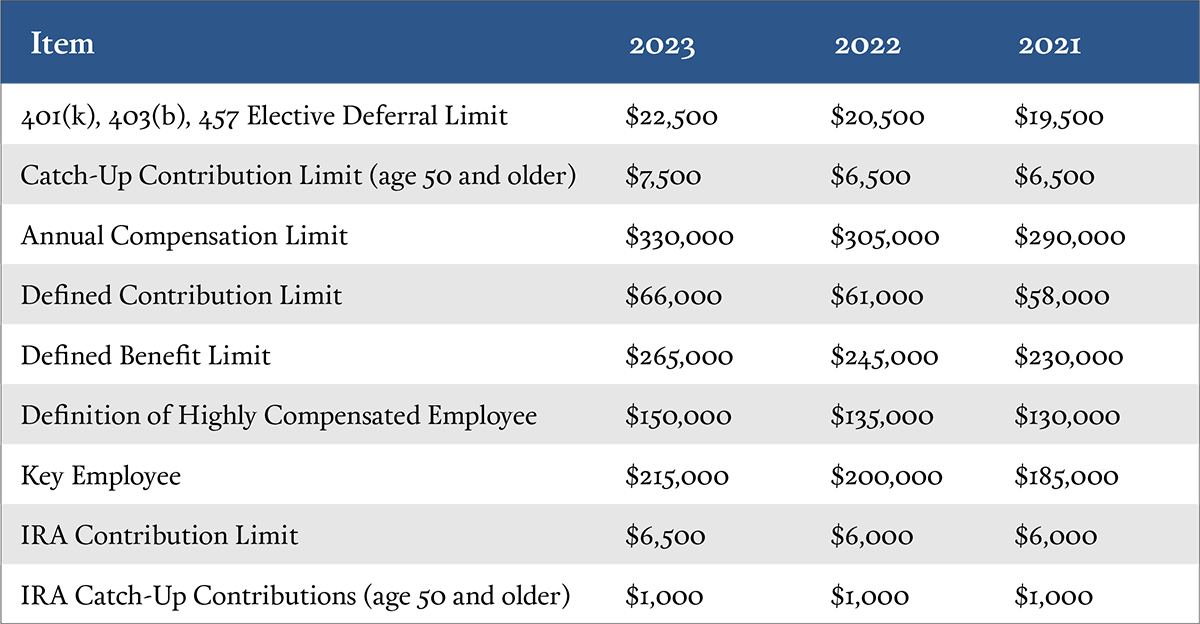

2025 401k Contribution Limit Catch Up Over 50. Starting in 2025, employees can contribute up to $23,500 into their 401 (k) and 403 (b) plans, most 457 plans, and the thrift savings plan for federal employees, the irs. If you're 50 or older, the irs allows you to stash away more money in your 401 (k) on top of the standard limit.

That’s on top of the standard $23,500 limit for everyone else,. In 2025, you can contribute up to $23,500 to your 401(k) at work, or up to $31,000 if you’re 50 or older.

2025 401k Contribution Limit Catch Up Over 50 Images References :

Source: rickymjacobo.pages.dev

Source: rickymjacobo.pages.dev

2025 401k Contributions Over 50 Ricky M. Jacobo, As is usual, contribution limit amounts have risen overall, too.

Source: nataliaparker.pages.dev

Source: nataliaparker.pages.dev

2025 Maximum 401k Contribution Limits Over 50 Natalia Parker, They can set aside up to $11,250 on top of the $23,500 standard contribution limit.

Source: ilysehjklorinda.pages.dev

Source: ilysehjklorinda.pages.dev

2025 Max 401k Contribution Limits Over 50 Emlyn Iolande, In 2023, only 14% of employees maxed out.

Source: adamvance.pages.dev

Source: adamvance.pages.dev

2025 Max 401k Contribution Catch Up Adam Vance, This brings their maximum 2025 contribution to $34,750.

Source: rickymjacobo.pages.dev

Source: rickymjacobo.pages.dev

2025 401k Contributions Over 50 Ricky M. Jacobo, As is usual, contribution limit amounts have risen overall, too.

Source: pierspiper.pages.dev

Source: pierspiper.pages.dev

401k Maximum Contribution 2025 Plus Catch Up Piers Piper, That means an active participant 50 or.

Source: rubysana.pages.dev

Source: rubysana.pages.dev

2025 401k Contribution Limit Calculator Single Ruby Sana, In 2023, only 14% of employees maxed out.

Source: graceasemerola.pages.dev

Source: graceasemerola.pages.dev

2025 401k Max Contribution Limit Over 50 Minne Allison, In 2025, you can contribute up to $23,500 to your 401(k) at work, or up to $31,000 if you’re 50 or older.

Source: samchurchill.pages.dev

Source: samchurchill.pages.dev

2025 401k Catch Up Contribution Limits 2025 Pdf Download Sam Churchill, In 2023, only 14% of employees maxed out.

Source: reahjktiffie.pages.dev

Source: reahjktiffie.pages.dev

What Is The Max 401k Contribution For 2025 With Catch Up Shirl Doroteya, The 401k contribution limits for the year 2025 are expected to see many increases in different plans including elective deferral limit to $24,000, defined contribution plan to.

Posted in 2025